When you play in a sport and follow the rules there is an expectation of a fair game with a winner and loser. If you watched the recent Super Bowl you may have seen two touchdowns by the Philadelphia Eagles that were scored and upheld. The National Football League (NFL) “catch rule” has garnered much consternation as being interpreted differently by officials. Confusing may be an understatement. This rule seems to vex coaches, players, fans and media announcers, causing much head scratching. Whether your team won or lost, this rule is maddening. Those who love the game agree that this rule needs to be carefully reviewed and changed. So, what does this have to do with taxes?

Rules and Regulations

We live in a world of laws, rules and regulations, and penalties are assessed for not following the first three. In a perfect world, you earn income, pay your fair share of taxes or else–well, maybe not? Welcome to the new tax law signed on Dec. 22, 2017. With any new law there are new rules, regulations and questions. Football fans are not the only ones who are perplexed and confused by rules. Taxpayers are scratching their heads or muttering under their breaths with these new tax law changes.

Confusion at Its Best

Investment News listed in its Jan. 15, 2018, edition the following topics that are affected by the new tax law: deduction “bunching,” Roth conversions, business pass-throughs, advisory fees and pre-tax IRAs, medical expenses, 529 plans, family gifting, and unintended consequences of tax law changes regarding losing miscellaneous itemized deductions and more.

As the Internal Revenue Service (IRS) promulgates new rules and taxpayers patiently wait for them to be finalized, questions are presented asking, what if? The long and short of the new taxes appear to be great for businesses and are mostly permanent. Individual tax payers may benefit, but it depends on the state in which you live. Also, the individual tax changes expire in 2025 unless extended or made permanent by Congress.

Business Income Pass-Through Deductions

One part of the new law deals with business income pass-through deductions. According to tax writer Ken Berry, “The new tax law–the Tax Cuts and Jobs Act (TCJA)–creates numerous tax-saving opportunities for businesses of all shapes and sizes. Notably, the new law carves out a brand-new tax deduction for owners of pass-through entities, including partners in partnerships, shareholders in S corporations, members of limited liability companies (LLCs) and sole proprietors.” Additionally, if your business is deemed a personal service corporation (engineering and architecture are specifically excluded), you are eligible to take advantage of the new law.

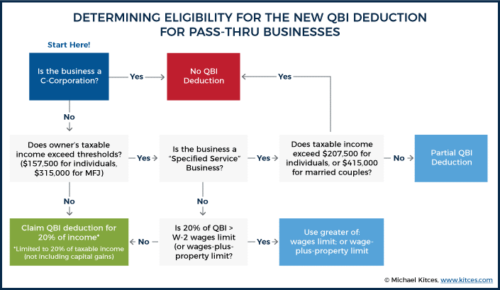

To claim any part of the 20 percent deduction, income must be deemed to be qualified business income (QBI) and meet the specified service business and wage and capital limit tests. If this isn’t confusing enough, the IRS requires other nuances and specific minutia be met to satisfy taking part in this deduction. Retirement planning reporter Greg Iacurci summed it up best, “However, the rules are complex enough to make even an accountant’s head spin.”

This new tax savings option is so complex that the following chart (source: Michael Kitces at Nerd’s Eye View) helps explain the mechanisms involved to obtain any potential benefit:

W-2 vs. 1099 Status

The potential for this tax saving opportunity may cause employees to wish their compensation and ultimately tax reporting be reformatted from a W-2 to a 1099 or independent contractor status. As the IRS states on its website, “The Internal Revenue Service reminds small businesses of the importance of understanding and correctly applying the rules for classifying a worker as an employee or an independent contractor. For federal employment tax purposes, a business must examine the relationship between it and the worker.” In other words, both businesses and employees should not take risks that ultimately cause any relationship changes that may be negated by the IRS. The penalties levied may exceed any potential tax savings.

Options + Questions = Confusion

Some may argue the new tax changes are a boon to financial professionals. The complexity involved in deciphering the maddening rules and regulations requires professional expertise to make sense of it all. With any change there is always some level of discomfort in learning what is entailed in making the changes work to one’s advantage within the parameters. Most importantly, making the right decisions to avoid pitfalls and potential penalties with any related costs. Individuals can also be self-directed and with helpful apps may be able to do it, as well. Whatever your decision, be prepared to possibly do it again in 2025, unless of course additional changes are made over the next few years. I guess that’s why it’s called a Hail Mary.

H. William (Bill) Wolfson, DC, MS, MPASSM, CFP®, is a financial consultant and advisor. Dr. Wolfson retired after 27 years of active practice. He is a member of the American Chiropractic Association (ACA), New York State Chiropractic Association (NYSCA) and Florida Chiropractic Association (FCA). Dr. Wolfson served as the ACA New York delegate and received the prestigious ACA Delegate of the Year Award in 2011. Dr. Wolfson can be reached at (631) 486-2792 or [email protected]. View more published articles here.